Executive Summary

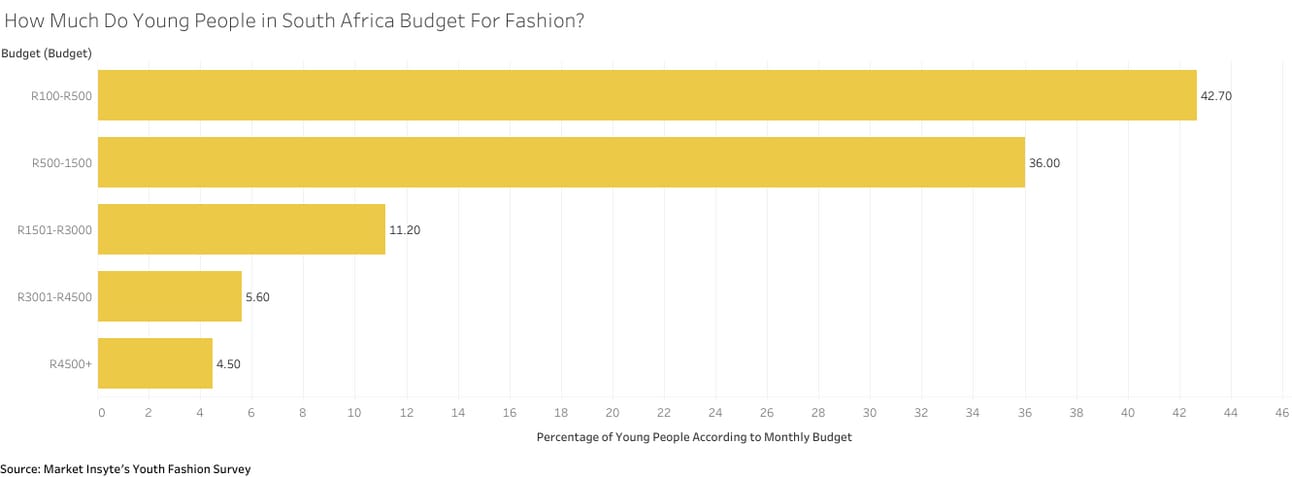

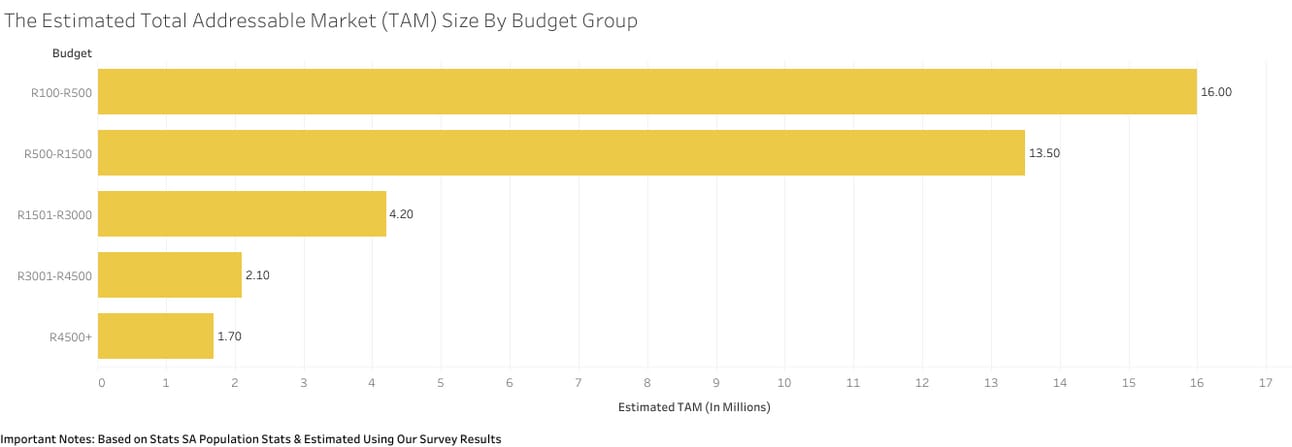

Fashion Frugal Segment: A significant 42.7% of young consumers, termed as 'Fashion Frugal,' allocate a monthly clothing budget between R100 to R500. Despite their smaller budgets, this segment represents a substantial Total Addressable Market (TAM) of 16 million individuals, emphasizing the potential for a lucrative fashion enterprise.

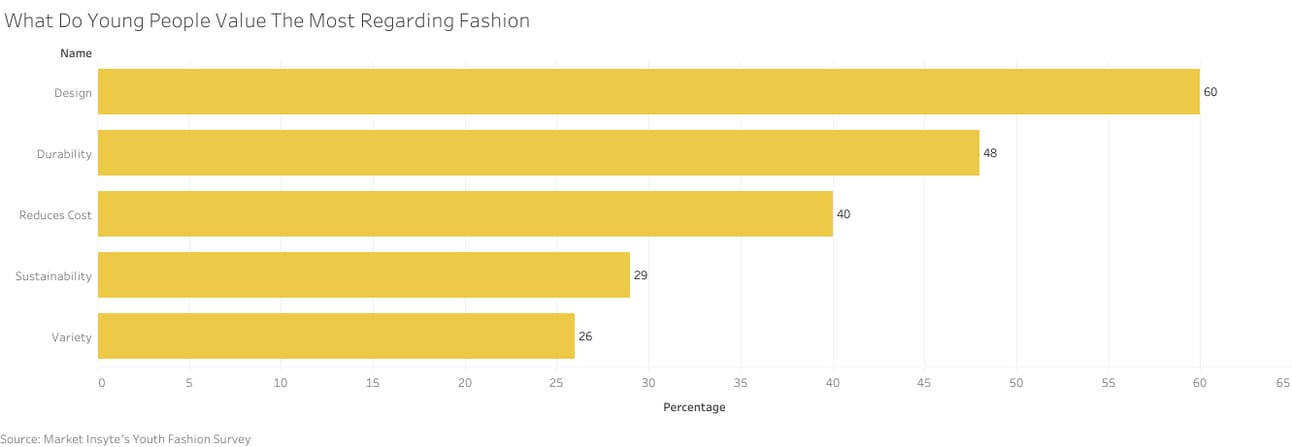

Value Drivers in Fashion: Design stands out as the top value driver, with 60% of respondents highlighting its importance. Durability and Price-consciousness follow, with 48% and 40% of respondents, respectively, emphasizing the need for long-lasting, cost-effective clothing.

Recommendations: Entrepreneurs should focus on creating attractive and desirable designs, ensuring durability through high-quality materials, and aligning pricing strategies with the budget constraints of young consumers. Moreover, incorporating sustainable practices and offering a variety of designs can enhance brand appeal and cater to the preferences of the youth fashion market.

Fashion plays a significant role in the lives of South Africa’s Youth. Fashion enables young people to not only express how they feel but also to influence their moods. Our snapshot survey of Youth fashion revealed that 57% of respondents use fashion to express their mood while 43% of respondents said they use fashion to influence their mood. This suggests something as ‘simple’ as a nicely fitted outfit is embedded in the fabric of the youth’s attitude. This article sheds light on the value of the Youth Fashion market and highlights that there is plenty of room for growth in the industry.

Why Should You Consider Starting a Fashion Business?

Firstly, the fashion retail industry in South Africa historically experienced healthy growth. For instance, South Africa’s fashion retail industry achieved consistent year-on-year growth between 2010 and 2019. The revenue grew by 49.19% between 2010 to 2019 with a Compound Annual Growth Rate (CAGR) of 14.3% over the same 10-year period.

Secondly, the industry is resilient to external shocks. Despite our estimated 13.3% decline in revenue from 2019 to 2020 due to the nationwide lockdown restrictions, there was a remarkable resurgence in the fashion industry's revenue in 2021. Industry revenue was approximately R168 Billion in 2021 compared to approximately R149 billion in 2020. This year, industry revenue is expected to be more than R186 Billion. The rapid recovery to pre-covid levels suggests that fashion retail has the potential to be a very lucrative industry for aspiring entrepreneurs.

Furthermore, the fashion retail industry is lucrative because of the vast size of the consumer market. The fashion retail industry was worth approximately R172 Billion in 2019 (at 2015 constant prices) and as the revenue trend shows this industry is going to continue to grow: clothing is an essential part of human existence. The local fashion retail industry caters to more than 60 million people in South Africa.

How Big Is The Youth Market?

Our survey used the national definition of youth as people under the age of 35. According to Stats SA, there are approximately more than 37.6 million youth in South Africa. This represents a massive business opportunity for fashion brands across the world as clothing is essential to everybody, especially the youth. If you’re an entrepreneur with aspirations to start a fashion retail brand, there are many ways you can position your brand in the market: you can target the toddler, pre-teen, teen, university or young professional market segments for instance.

How Much Are Young People Willing To Spend On Fashion?

In our snapshot survey of 89 young people, we asked respondents what their monthly clothing budget is. The majority of young people plan to spend between R100 to R500 per month on clothing highlighting that the youth’s spending power is not as high as other age groups. Despite the smaller budgets, the sheer size of the market means you can still establish a lucrative fashion enterprise. Let’s call this segment ‘Fashion Frugal’ and assume they represent 42.7% of the youth fashion market. That equates to a 16 million Total Addressable Market (TAM) population if we generalise our findings. The second largest segment (36% of respondents) in our sample are people who budget R501 to R1500 per month on clothing. However, there are segments that have bigger monthly clothing budgets. For instance, 10.1% of youth plan to spend at least R3000 per month on clothing.

The Estimated TAM by Budget Group

What Drives Consumer Behaviour?

Pertaining to value drivers (things that increase consumers’ perceived value of products and services) in the fashion industry, young consumers have a clear top five. We asked respondents what the top 3 things they value most when dealing with fashion brands. Respondents chose from 14 different options.

The number one factor is Design. Design featured in 60% of respondents top value drivers in our survey. Before launching items of clothing or other accessories, entrepreneurs must ensure their designs are attractive and desirable to their potential customers. We advise creating mock-ups and asking your target market what they think of your designs or asking your clients what their preferences are regarding the overall style and fit of the clothing: for example, do they want slim fit or loose fitting clothes?

Secondly, young people value Durability. 48% of respondents selected Durability as one of their value drivers. This means that young people want clothes that will last them long without succumbing to rapid wear and tear. There are a few tactics entrepreneurs can use to leverage this value driver such as making clothing care tutorials and sourcing high-quality materials from suppliers.

The youth are also very price-conscious. 40% of young people chose Reduces Cost as one of the most important factors in their fashion choices. Entrepreneurs should develop pricing strategies and promotions that are aligned with young people’s fashion budgets and consumer demand. Be intentional about determining what your target audience is willing and able to spend on your different clothing lines by using personalised market research solutions and talking to potential customers.

Sustainability is another core value driver for young consumers, as it features in 29% of respondents’ key value drivers. Business models such as clothing rentals or resale present viable business opportunities for fashion retailers.

Lastly, young people like to have options. Variety featured in 26% of respondents’ top value drivers. This means that entrepreneurs should create multiple designs and styles to cater to young people’s desires. Explore implementing a multi-brand strategy or regularly introducing different designs under the same label.

Do You Need More Insights?

Our extensive Fashion Industry Report provides entrepreneurs with the detailed information and analysis they need to design and launch their fashion empires. Our report will help you develop clear strategies to launch your business and thrive in South Africa’s fashion industry. We help entrepreneurs answer questions such as “Which business opportunities are the most lucrative?” “Where can I find suppliers for my business?”, “How should I price my clothing lines?”, “How should I position my business?” and so much more. If you need clarity and understanding of the fashion industry, our market research report is perfect for you. Get your copy today.

How can we help you?

Market Insyte offers personalised market research services tailored to entrepreneurs' needs.

If you would like to schedule a business model consultation, feel free to book a session here

If you would like us to conduct a personalised market research study, feel free to schedule a complimentary discovery call

Browse our public market research librarymARKET