EDTECH

A smart classroom refers to a physical learning environment which incorporates technologies such as laptops, projectors, smart boards and other technological devices into the learning and teaching experience. The core purpose of smart classrooms is to leverage various technologies to improve student-teacher interactions, enhance the quality of teaching and improve learning outcomes for students. Research also states that smart classrooms can use different digital tools to help with certain administrative tasks, such as attendance, assessment, and real-time feedback. Saini and Goel developed a comprehensive taxonomy of what a smart classroom consists of:

Smart Content: This refers to the preparation, delivery, and distribution of the educational content or program/lesson/lecture. Smart classrooms are characterised by the use of multimedia content

Smart Interaction and Engagement: This encapsulates how technology is used to enhance the interaction among students, the interaction between a teacher and a student, and the engagement of students during the course of the learning experience.

Smart Assessment: This includes technologies used to aid in the assessment of student learning (quizzes etc.) and feedback to the teacher (lecture quality).

Smart Environment: A smart classroom should also have a healthy physical environment (temperature, humidity, etc.).

This taxonomy signals how diverse and big the opportunity landscape is for entrepreneurs who want to establish themselves in the market. Startups can create web-based presentation or assessment tools, manufacture hardware devices to improve the learning experience, or leverage AI to help teachers deliver personalised learning experiences for students. This report presents everything founders and investors must know about the smart classroom market in South Africa.

1. Market Overview

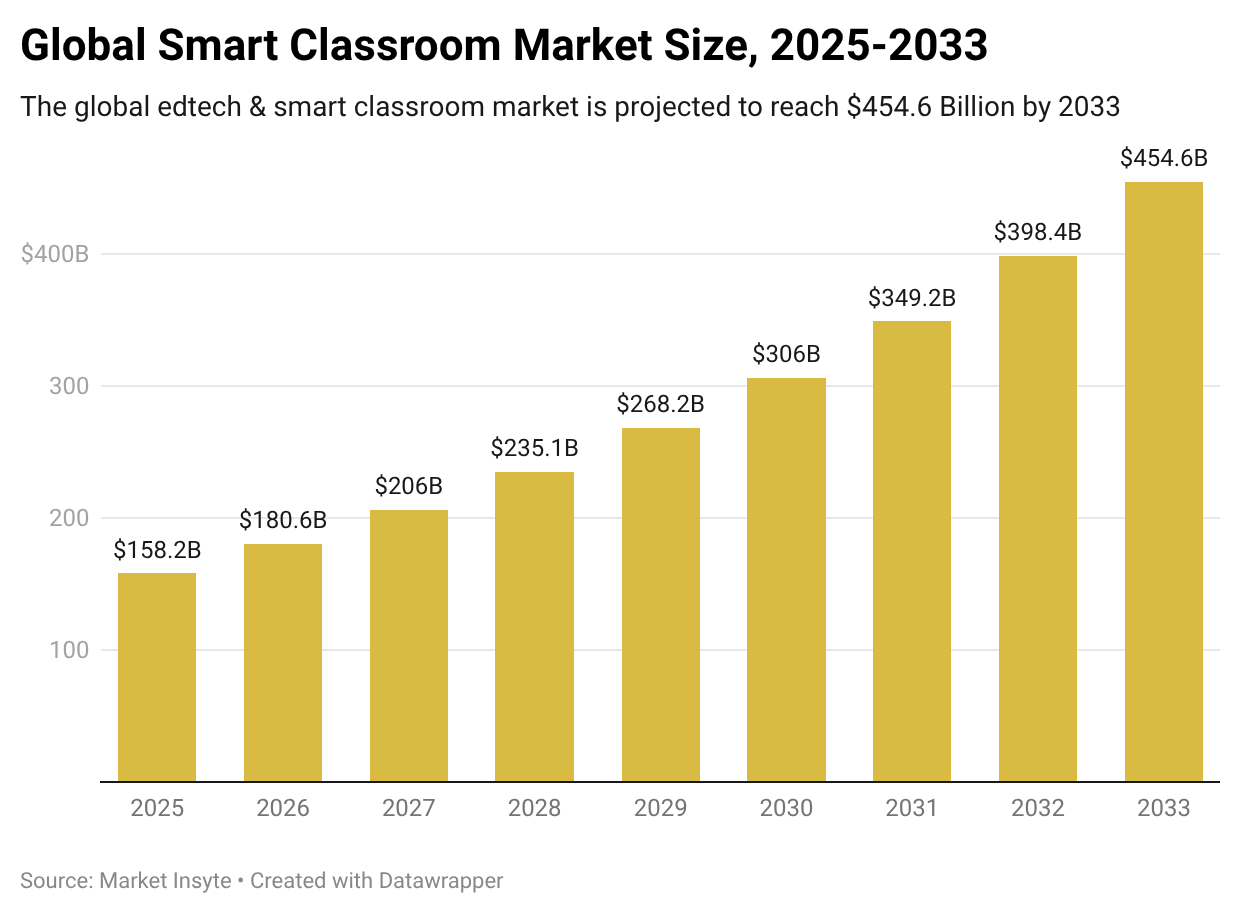

Based on our estimates, the global smart classroom market was valued at USD 158.24 billion in 2025 and is projected to grow to USD 454.57 billion by 2033 at a 14.1% CAGR, indicating strong, sustained global momentum. According to multiple reports, hardware accounted for 41.5% of market revenue in 2025, making it the largest component, while content platforms captured 24.2% of the market.

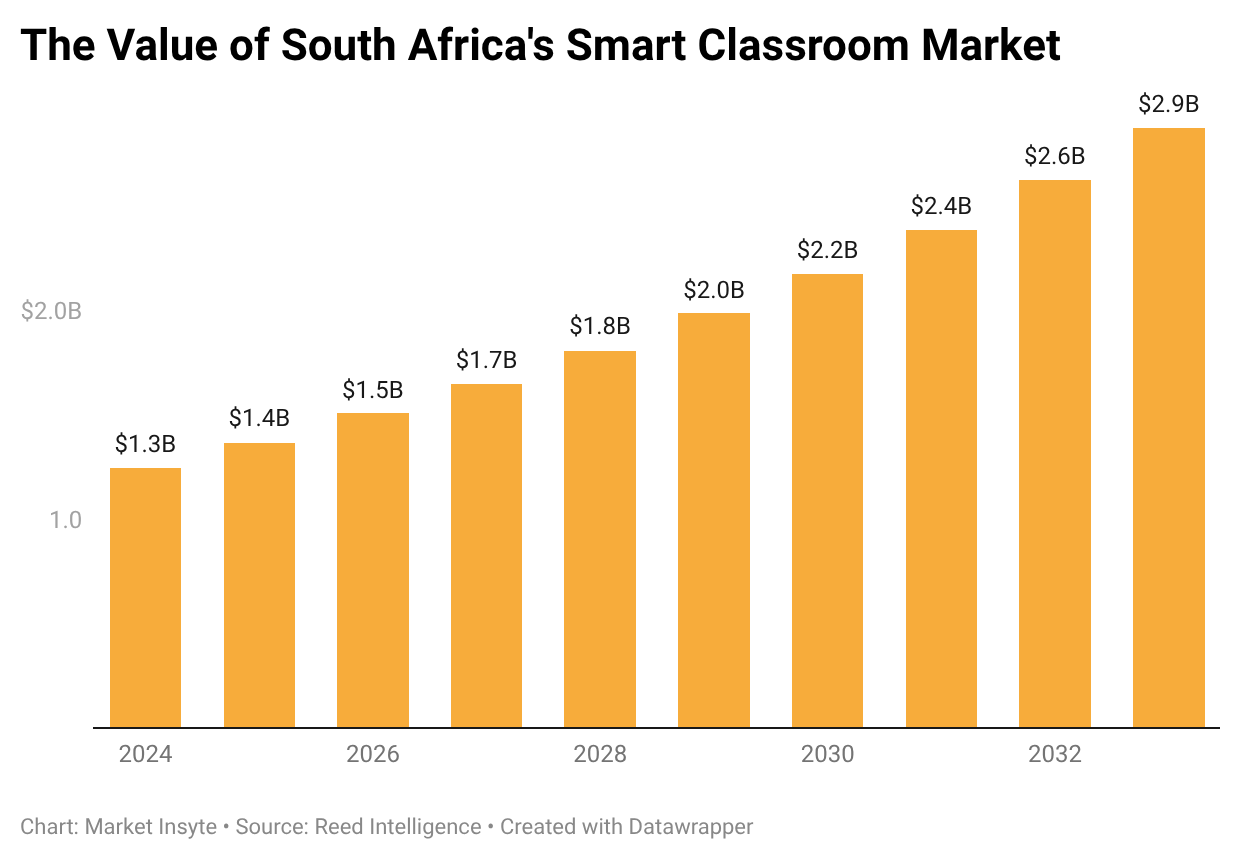

Despite the global market’s growth potential, South Africa’s market is still in its infancy compared to more mature markets. According to research by Reed Intelligence, South Africa’s smart classroom market size was $1.25 billion in 2024 and will be valued at $2.9 billion by 2033 at a 9.73% CAGR. This means our estimated global CAGR (14.1%) significantly exceeds South Africa’s smart classroom CAGR (~9.7%), suggesting SA is a moderate-growth market by global standards.

1.1 The Basic Education Market Segment

According to the Department of Basic Education (DBE), there are 24,836 schools in South Africa. The largest segment in South Africa is the public schools segment, accounting for 90.64% (22,511 schools) of the market. There are 2,325 independent schools in South Africa. The number of schools in South Africa decreased slightly by 0.2% from 2021 to 2023.

According to the DBE, there were 13,439,683 primary and secondary school learners in 2023. According to Stats SA, 15.6 million learners enrolled in school in 2024. This shows that local edtechs can cater to a sizeable market and play a significant role in ensuring the future workforce is adequately equipped. These learners are concentrated in the following four provinces: KwaZulu-Natal, Gauteng, Limpopo, and the Western Cape.

There were 454,749 educators in public and independent schools in 2023, representing a 3.4% growth from 2021 to 2023. KwaZulu-Natal, Gauteng, Limpopo, and the Western Cape have the most educators among the provinces.

1.2 The Higher Education Market Segment

Although this segment is dominated by 26 public universities, there are notable private institutions such as Varsity College and Regent Business School that play a significant role in the smart classroom market.

In terms of students, the market size has grown significantly between 2009 and 2024. In 2025, 1.7 million individuals were enrolled at a higher education institution. Furthermore, the participation rate of individuals aged 18-29 years increased to 5.3% in 2024 compared to 4.3% in 2002. Despite this progress, the participation rate is still too low to drive effective change in the labour market: 16.1% of people older than 20 years old have a qualification higher than a grade 12 certificate.

2. Trends & Drivers

2.1 Artificial Intelligence

2025 showed a clear shift from “AI as add-on” to AI-first classroom resources that personalise instruction, streamline teacher workflows, and begin to act autonomously in limited, supervised ways. National plans (e.g., Korea’s tablet-based AI textbooks) and device/board makers (LG CreateBoard) indicate institutional investments in AI-enabled curricular materials and classroom infrastructure. Integrating AI with existing school ecosystems (Microsoft Copilot, Google Gemini pilots) reduces friction for teachers and admins while creating new technical and governance requirements (FERPA, data protection). The combined effect is more adaptive lesson sequencing, automated content generation, and context-aware aids (subtitles, summaries) that scale across classroom sizes and geographies.

2.2 Policy Revision

South Africa is revising the outdated 2004 e-education policy in order to secure the future of digital education in the country. In 2025, the Department of Basic Education announced the creation of a national Digital Education Strategy to reimagine the future of Basic Education. The strategy focuses on the provision of tools, improving infrastructure, and equipping learners and teachers with digital skills.

On a continental level, the African Union (AU) developed the first draft of the African Edtech 2030 Vision and Plan for Africa. The Africa EdTech 2030 Vision & Plan outlines a continent-wide commitment to using education technology to improve learning quality, equity, inclusion, and system resilience across Africa. Aligned with major continental frameworks such as Agenda 2063, STISA 2034, CESA 2026–2035, and the AU Digital Transformation Strategy, the plan provides a unified roadmap for leveraging EdTech to deliver accessible, high-quality education.

2.3 Public-Private Collaboration & Investments

Due to the aforementioned policy efforts, public and private partnerships are increasingly important. Such partnerships have led to commendable progress in ICT adoption in schools in South Africa. According to the DBE, 545,938 ICT devices were purchased for learners during the 2022-2024 financial years. These procurements enabled the digitisation of textbooks and learning materials. Furthermore, 30,818 ICT devices were purchased for teachers during the same period. 10,588 classrooms were equipped with ICT resources for teaching and learning. 535,633 learners received connectivity for learning, while 59,991 teachers received connectivity to help them deliver their content digitally. Partnerships with Vodacom, Cell C, Telkom, MTN, and Openserve have enabled this. As illustrated in the graph below, through these partnerships, more than R7 billion was spent on ensuring more ICT adoption in schools from 2022 to 2025.

The Department of Basic Education’s Rural Education Directorate, in partnership with MiDesk Global, handed over 110 smart desks to Boschkop Primary School on 11 August 2025, highlighting the impact of public-private partnerships in advancing inclusive, future-ready education. The mobile desks—equipped with a writing surface and solar-powered light—are designed to support learning both at school and at home, particularly in low-resource settings. Officials and partners emphasised that the initiative goes beyond infrastructure, positioning the desks as tools that expand access, inspire ambition, and create meaningful learning opportunities for rural learners.

The Gauteng Department of Education has rolled out 8,596 smart classrooms, prioritising township and selected primary schools. Equipped with LED interactive boards, training, and maintenance, the initiative supports digital, interactive learning. Investments span three years, though budget constraints limit expansion in 2025/26.

3. Challenges

The following factors will make it challenging to enter the smart classroom market in South Africa.

3.1 Fragmented ICT Infrastructure

National internet access in schools has improved steadily over the past decade, rising from 35% in 2011 to 56% in 2017 and reaching 67% by 2022. This positive trend is reflected across most provinces, except for the North West and Western Cape, which experienced slight or minimal declines compared to 2017 levels. In 2022, the Free State, Gauteng, Northern Cape, and Western Cape recorded the strongest connectivity, each reporting internet access in more than 90% of schools. However, despite these overall gains, significant disparities remain. The Eastern Cape and KwaZulu-Natal continue to lag behind other provinces, with only 54% and 40% of schools connected to the internet in 2022, respectively.

3.2 Resource Constraints

According to the SASE: Whole School Evaluation 2022 Report, only 22% of learners across the three grade levels had adequate access to ICT in their schools. While feedback indicates that schools have started integrating ICT into teaching and learning—largely driven by the COVID-19 pandemic—there is still considerable progress to be made to ensure meaningful and widespread access. Limited financial resources are widely recognised as a major obstacle to the adoption of EdTech. Many studies highlight that education technologies are often costly, making them inaccessible to schools with constrained budgets. As a result, numerous schools are unable to afford the infrastructure and tools required to adequately equip their classrooms.

3.3 Poor Digital Skills

Research reveals that challenges in understanding and effectively using educational technologies often influence educators’ attitudes toward them. Research indicates that educators can sometimes experience EdTech as complex or overwhelming, underscoring the ongoing need for additional training and professional development. This is reflected in the SASE report as some educators stated that even though they have access to ICT tools, they don’t use them often due to a lack of the required skills. Most studies emphasise that educators’ skills and training are critical to the successful integration of technology into teaching and learning. While a large body of research points to the need for general digital literacy and technology training, some studies go further by highlighting the importance of more targeted, practical training. In particular, they find that educators need guidance on how to meaningfully apply EdTech within lessons, rather than training that focuses solely on the tools themselves.

4. Strategic considerations

Although the local Smart Classroom market is set to experience 2X growth within the next ten years, significant progress must be made, especially in the basic education segment. The basic education segment still suffers from fragmented infrastructure, resource constraints and inadequate digital skills among learners and teachers. On the other hand, the tertiary education segment is more advanced technology-wise, but the market is significantly smaller in terms of the number of learners.

Furthermore, although the hardware sector enjoys the lion’s share of the market, the sector is dominated by established firms such as Huawei, and the startup costs will be significantly higher compared to starting a software business. Entrepreneurs must also think about the types of solutions they want to create based on the following areas:

Smart Content: You can create solutions such as presentation software, e-textbooks, or AI generative platforms to help teachers efficiently develop lessons.

Smart Interaction and Engagement: You can create hardware (tablets, digital whiteboards), software (polls), or even VR/AR tools to help foster better engagement in classes.

Smart Assessment: Entrepreneurs can create automated assessment tools to improve workflows for fairness, detection and teacher-managed oversight.

Smart Environment: Founders can sell equipment to monitor and control the physical environment to ensure learners and teachers have the best experience.

Given the latest global and local innovations and developments, the smart classroom opportunity is one we will be paying close attention to over the next few years. If you are an entrepreneur aspiring to explore and enter this Edtech segment, reach out to us today to discuss your needs.

Market Insyte offers personalised market research services tailored to entrepreneurs' needs.

If you would like to schedule a business model consultation, feel free to book a session here

If you would like us to conduct a personalised market research study, feel free to schedule a complimentary discovery call

Browse our public market research library